Trinidad’s Prime Minister Keith Rowley flew to Guyana for two days at mid-week with official pronouncements indicating the two will sign a pact relating to energy, agriculture and other issues but speculation was rife that the visitors might well make a pitch to refine some of Guyana’s oil there, thereby preventing a large and lifeline refinery from closing in Trinidad.

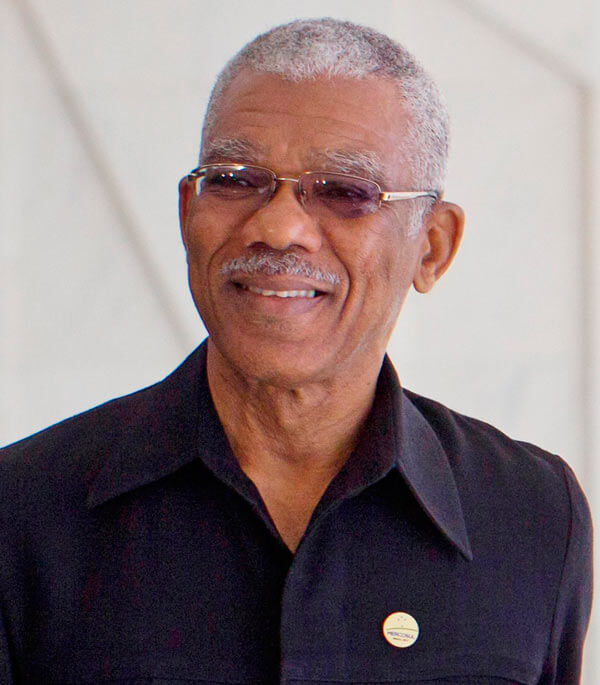

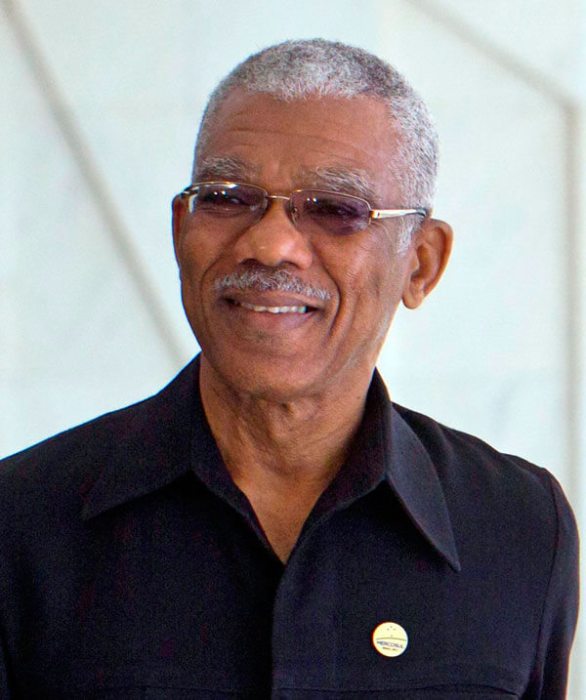

Rowley and Guyana’s President David Granger signed the memorandum of understanding at midday on Wednesday as controversy swirled in Trinidad over the impending closure of the Petrotrin Refinery in South Trinidad and the loss of jobs of more than 4,000 workers. Original figures had put the job losses level at about 2,000 but cabinet ministers and top Petrotrin officials are now admitting that the final figure will double original estimates.

Critics say that the plans to close the underperforming, money-losing refinery will devastate the economy of the so-called South in Trinidad as thousands of families depend on its existence directly and indirectly.

Oil production, led by a consortium by global oil major ExxonMobil, is scheduled to begin in late 2019 or early 2020 following the discovery of “world class deposits” offshore Guyana in 2015. Exxon has since drilled 11 commercial wells with nine yielding large deposits of sweet, light crude. The company now boasts that the Guyana strike rate ratio of successful wells is the highest anywhere in the world in living memory and bodes well for the future. “We are not going anywhere. We will be here for decades,” said company spokeswoman Kimberly Brasingtom.

Guyanese officials are yet to pronounce on if and where Guyana would refine its portion of oil production or sell raw crude in the open markets so added significance has been pinned to PM Rowley’s visit in the wake of calls by Opposition Leader Kamla Persad-Bissessar and others in Trinidad for Guyana to save the Petrotrin Refinery by refining its oil.

Guyana shares decades of close relations with the twin island republic, with Trinidad andTobago writing off more than $120 million in debts to Guyana more than a decade ago under favorable Paris Club forgiveness terms. Some at home think it is Guyana’s term to help Trinidad. Others say that decades of boasting and bragging about the twin island’s economic prosperity are coming to an end with oil production there at only 40,000 barrels per day, while Guyana is planning to reach 75,000 by the first five years of production. Trinidad should be made to suffer alone they argue. The Guyanese oil fields are about the third of the way in open waters to Trinidad.

As Rowley engages in talks with Granger and other Guyanese officials, he did tell the powerful Oilfield Workers Trade Union (OTWU) that authorities would seriously consider any serious offer for a worker-led buyout and operation of the refinery to save jobs and the economy of the area. Trinidad has been forced to spend millions in foreign exchange earnings to import 100,000 barrels of oil daily to keep the refinery open as local production has dwindled to a mere dribble.

Rowley told President Ancel Roget that cabinet will approve the sale of the refinery to new owners once the buyers accept full responsibility for and are willing to “present and commit to the rigors of an acceptable business proposal” even as he warned that if “more attractive offer comes up,” authorities will jump at it.

He said authorities had undertaken “the very difficult decision to close the refinery,” and suggested that the refinery will be separated from other businesses of the company to make it viable then as a “stand alone, as an asset for which a future of some sort would have to be designed.”

Trinidadian officials say the question of refining Guyana’s oil will come up as other companies with offshore concessions are highly likely to find commercial quantities of oil and gas in the coming months in a basin that the US Geological commission says contains billions of barrels of untapped, virgin fields.

Just recently, Exxon said that a third drill ship will arrive in Guyana in mid October and it may be forced to order up to five huge floating production and storage ships that will sit near drill rigs to store oil heading to international markets, an indication of the quantity of oil it will have access to in the near future.