Barbados is on a count down to a target that will place the country’s dollar in a position to once again assure local and international investors of its firmness as a currency in which to invest.

The aim is to return the island’s foreign exchange reserves to and above the Bar$1 billion mark that ensures the exchange rate of Bar$1 equalling 50 cents US remains unchallenged thereby comforting investors that any money pumped into enterprise on the island will retain its value.

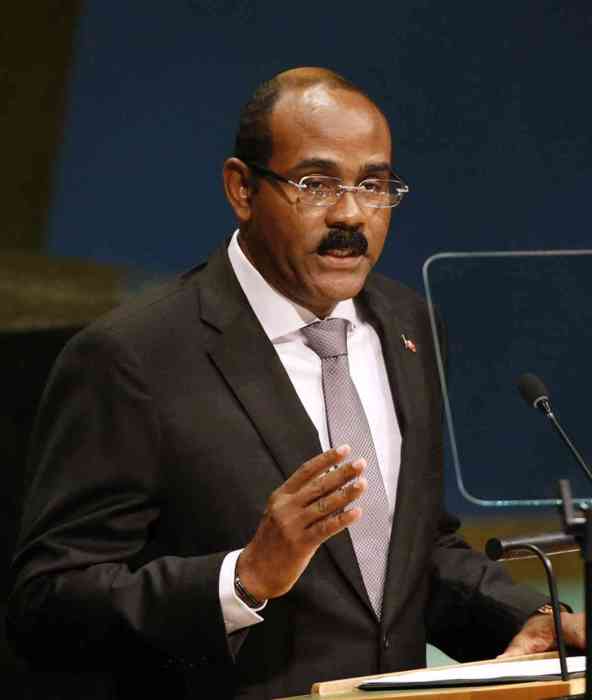

Prime Minister Mia Mottley confidently spoke of the Barbados billion-dollar international currency reserve target last Sunday when she and the Inter-American Development Bank President, Luis Alberto Moreno, signed a US$100 million loan to finance a macroeconomic programme.

“It also allows the country to create a buffer in our foreign reserves,” Mottley explained of the IDB concessionary loan along with others already received and those pending from additional international agencies.

“Once these funds are received from the IDB, the government of Barbados will end this calendar year for the first time in a very long time with over Bar$1 billion in reserves,” she said.

Taking the island to that figure in reserves by the end of 2018 means regaining a level it has not had since 2015, during which time the economy was on its way down in a freefall that had begun a few years earlier.

With that past tumble in reserves investor confidence fell away and international lenders began insisting on punishingly high interest rates for any loans towards Barbados because the island’s currency value was deemed to be at risk.

But through a quick readjustment of its finances by first suspending international debt payments, renegotiating local debt and striking a successful deal with the International Monetary Fund, the six-month-old government has regenerated international business confidence that resulted in a halt in the credit rating downgrades, which had numbered 22 over the last 10 years.

Over the weekend, the country received its first credit rating upgrade in about 10 years, from New York-based rating agency Standard and Poor’s.

In spite of the upgrade, Barbados’ bonds are still in the junk category but the slight credit rating elevation represents a turnaround that began with approval of concessionary loans from the IMF, US$290 million; Caribbean Development Bank, US$75 million; and the US$100 million signed onto with the IDB Sunday, all within six months.

“The terms and conditions with respect to the interest rates are much better than we would ever get from any commercial or capital markets,” Mottley had pointed out, as she stressed that the concessionary conditions of Barbados’ new borrowing are what the island needed in its climb out of the current economic hole.

This, along with several initiatives that stimulated some economic growth, provided the basis of Prime Minister Mottley’s confident prediction of the nation’s foreign reserves returning to a solid basis of above Bar$1 billion by yearend after it stood at a low of Bar$473.4 million at the end of 2017.